What is an offset mortgage?

Offset mortgages are something of a niche financial product, although not a novel one, having been available for many years. Given current economic conditions, with interest rates trending higher than we’ve seen for many years, an offset mortgage could be a valuable tool at this moment in time.

An offset mortgage functions similarly to other mortgages in most regards:

• It is a secured loan enabling you to buy a property or remortgage a property.

• It can have a term of up to 35-40 years, it can be capital and interest or interest only.• It can have a fixed-interest rate, or something else.

Where an offset mortgage is unique is with the addition of a linked savings account.

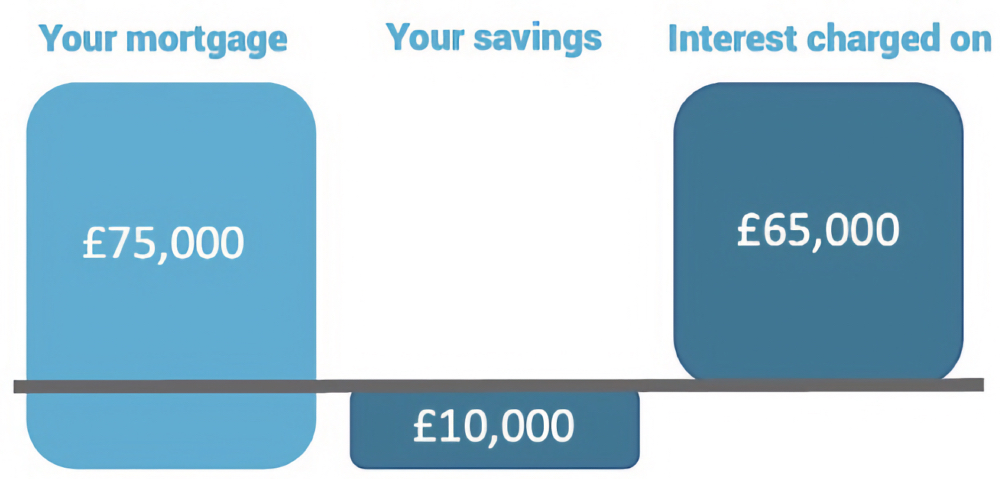

When the new mortgage starts, the borrower will designate a savings account (usually a new savings account with the same lender offering the mortgage) which will be linked to your mortgage. Any funds deposited in the linked savings account will be, as the name suggests, offset against your mortgage balance. This means you only pay interest on the difference between the two balances.

Any cash savings can be deposited in the offset saver account but does not earn you interest as it would in a regular cash deposit account. Instead, the deposited funds save you from needing to pay interest at an equivalent rate to the mortgage.

How an Offset Mortgage works

Once funds have been deposited in the offset saver account, they are effectively regarded as having reduced the balance of the mortgage by the total amount in the account. So long as the money remains in said account. As such, the mortgage will be recalculated in one of two ways the month following any deposits into the offset saver account:

Pay less each month: the offset funds will be used to reduce your monthly repayments, meaning the term of the mortgage will stay the same, but the monthly repayments will reduce as more funds are offset.

Pay the mortgage off faster: the offset funds will be used to reduce the mortgage term, meaning the monthly repayments will stay the same, but the mortgage term will be reduced as funds are offset.

You will choose which option you prefer when the mortgage starts and it cannot be changed for the duration of the term.

The Benefits of Offsetting

Offset mortgages can save you money, either by reducing your monthly outgoings, or by shrinking the term of the mortgage, enabling you to pay it faster and pay less interest over the years as a result.

Let’s look at an example:

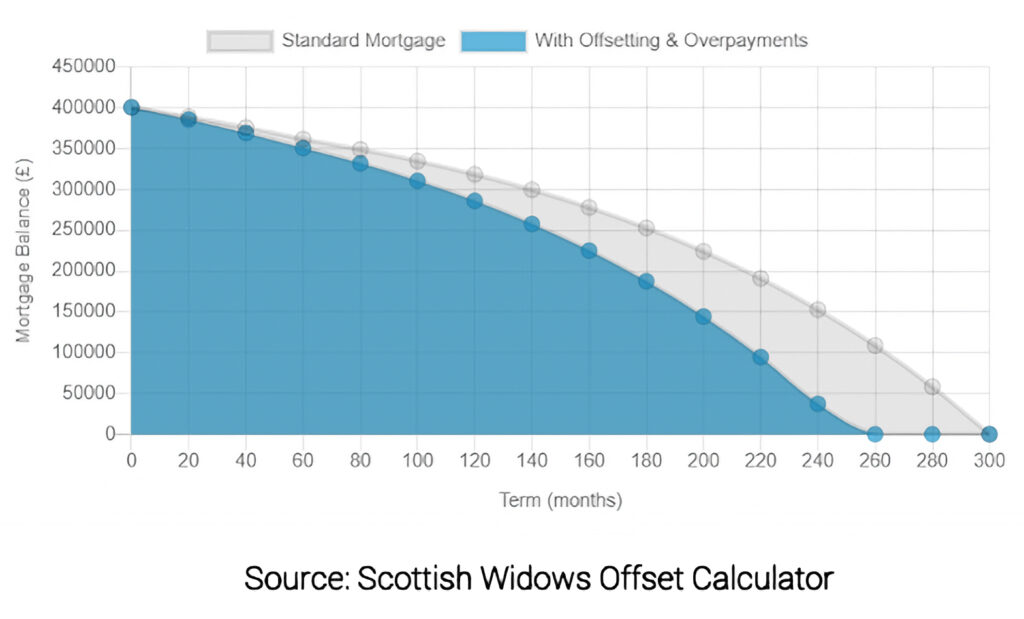

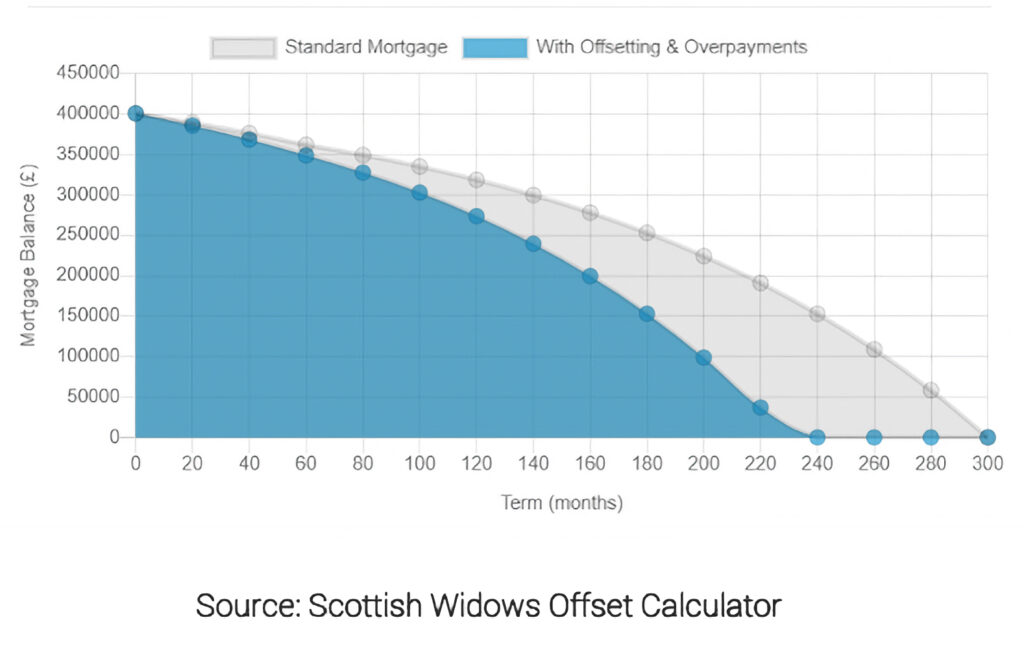

A couple owns a property worth £500,000, and they have an outstanding mortgage of £400,000, with a term of 25 years. The new mortgage product is a five-year fixed rate of 6.29%, making the monthly repayments £2,653.70 per month.

What would be the effects if they had cash savings of £30,000 which they could move to a new offset saver account when the mortgage starts? (This example assumes a reversionary rate of 6%)

If they chose to reduce the term of the mortgage, the initial £30,000 deposit would see them repay the mortgage 4 years earlier, saving £150,638.79.

If this couple moved £30,000 savings across to the offset saver when the mortgage starts, but also deposit £200 a month into the offset saver, then they would repay the mortgage 5 years 8 month earlier, saving £213,786.67.

• If they deposited £30,000 in the offset saver from outset, and opted to reduce monthly repayments, the monthly repayments would reduce from £2,653.70 pm to £2496.45 pm, saving £59,327.60 in total.

• If they opted to deposit £30,000 in the offset saver from outset and then a regular £200 per month, they would have saved £114,572.33 in total.

Why choose an offset? What are the benefits?

If you have a mortgage coming to an end and need to remortgage soon, you’ll probably be unable to obtain a fixed rate of any less than 4-4.50%, at the time of writing. If that’s the case, and you have cash savings deposited elsewhere earning you interest of perhaps only 2-3%, the offset product offers better value for money. This is because the interest rate you would pay on the mortgage is higher than the interest rate you accrue on that savings account.

The mortgage interest rate that would be offset effectively becomes the benchmark against which other uses of the savings need to be judged. With rates of 4-4.50% on new mortgages, it’s difficult to see other options delivering a superior return that doesn’t involve taking risk with those funds. As the money remains in cash throughout in an offset, there is no investment risk.

In addition to this, cash savings that earn you interest in the traditional way are subject to income tax. That is not a factor with offset mortgages. Each person has a savings nil rate band they’re entitled to each year – which is £1000 for basic rate tax payers or £500 for higher rate tax payers – but anything in excess of this will be taxed at the saver’s highest marginal rate of income tax. For a higher rate tax payer therefore, any interest on their savings in excess of £500 will be taxed at 40%. This means the rate of return on their savings would need to be higher than the mortgage interest rate net of tax to truly be offering better value for money.

Let’s take a look at an example of the potential financial benefits of an offset mortgage:

Mrs. Client, a higher-rate taxpayer, has a mortgage of £300,000, repayable over a 25-year term, on a rate of 5.5%, and if she wants to, she can have an offset saver account with this mortgage. She has £50,000 in cash savings, earning interest at a rate of 4%. Will she be better off offsetting, or leaving the money in her current savings account?

1) In this scenario, the annual interest earned on her savings will be £2,000 (£50,000 x 4%). As a higher rate tax payer, £500 of this will be tax free, leaving the remaining £1,500 taxed at 40% (£600). There is therefore £1,400 profit on her savings of £50,000.

2) Interest charged on £50,000 at a rate of 5.5% (the rate of the mortgage) would be £2750, which outweighs the interest earned on her current savings as they are now, but how high would the interest on her savings need to be to be worth more than offsetting in this case?

3) Because of the tax that would be due, the benchmark rate for her savings is effectively ‘grossed up’ by 40% in order to allow for the tax that would be deducted on her savings. This means that the interest would need to be 9.16% (5.5% / 0.6 = 9.16%) to match the benefits of the offset mortgage.

4) £50,000 x 9.16% = £4580 per annum. £500 of this would be tax free, but £4080 would be taxed at 40%, which is a tax liability of £1632. The net return on £50,000, with an interest rate of 9.16%, is therefore £2948. This is only marginally higher than the interest of £2750 that would be offset.

As offset funds are not deemed to be overpayments, there are no restrictions on the amount that can be offset, either via a lump sum or regular monthly contributions. This means for those looking to pay the mortgage off faster, an offset enables you to effectively clear the balance without incurring early repayment charges. An offset could be ideal for people who anticipate inheriting money which can be used to reduce the mortgage balance, people who anticipate receiving lump sum bonuses which can be used to reduce the mortgage balance, or just those who want to make regular overpayments without worrying about early repayment charges.

Costs & Considerations

Here are facts that people should be aware of when considering an offset mortgage:

- Offset products often, but not always, have slightly higher rates than other mortgages, so there is effectively something of a ‘premium’ for having access to the offset saver account.

- If you do not have any current cash savings, or don’t realistically feel like you’re able to contribute regularly to an offset saver account, then it may be better just taking a standard mortgage product if this involves having a lower interest rate.

- It isn’t possible to add an offset facility to an existing mortgage product. A remortgage would be required in order to access one for those who already have a mortgage, in which case it is necessary to be aware of any early repayment charges that might apply to the existing mortgage.

- There is a limit to the effects of offsetting. Once the offset balance is equivalent to the mortgage, there is no interest due at that point, and no further benefit to offsetting funds. Once that point is reached, borrowers should either make capital overpayments, or divert funds to another purpose.

- Funds in the offset saver account can be accessed again after being deposited, much like they would with a normal cash savings account. If funds are taken back out of the offset saver account, the mortgage will simply be recalculated again, with either the monthly repayment or term increasing accordingly. For this reason, offsetting is not the same as making capital overpayments, as when making overpayments, the funds are permanently paid off the mortgage and can’t be retrieved again afterwards. Some lenders may impose restrictions on this, so it’s important to be aware of this before agreeing to the mortgage.

An offset mortgage is a more complex financial product than a standard mortgage, and advice should be taken before applying for one.

Summary

By reducing the amount of money on which interest is owed, offset mortgages currently deliver better ‘returns’ than many other investment options. This is particularly true for those with pre-existing cash savings deposits and higher and additional rate taxpayers, for whom more of their savings income will be liable to tax.

An offset mortgage will not be right for everybody, and can be more complicated than a typical mortgage. However, at this point in time, those with cash deposits faced with a paucity of attractive investment options can look to an offset mortgage seeking value for money.

If the flexibility and potential savings outlined in this guide sound appealing, then an offset mortgage could be right for you.

Article by Cain Stennett

Mortgage and Protection Adviser

Financial Planner Dip CII, Certs CII (MP & ER)

This article is no replacement for expert mortgage advice. As such, please do reach out to our qualified specialists who can assess your individual situation and provide the best advice for you.

If you're considering an Offset Mortgage we'd love to help.

It’s important that your circumstances are aligned to the benefits and requirements of an Offset Mortgage. For free bespoke advice, book a meeting down below with the team at Bigmore Mortgages & Protections.

Note: Your property may be repossessed if you do not keep up repayments on your mortgage.

Money Stories: The Singles Tax

Previous post

Money Stories: The Singles Tax

Previous post