Should companies start providing Group Private Medical Insurance?

Group Private Medical Insurance has never been a more essential consideration. A government minister has recently announced that they will miss their target on reducing NHS waiting times. With the current waiting times for treatment at an all time high, and individuals increasingly looking to pay privately for treatment, there has never been a more important time for Companies to offer Group Private Medical Insurance as an Employee Benefit to help employees beat the NHS backlog.

This article is aimed towards HR Directors of Companies that are thinking of putting Group Private Medical Insurance (PMI) in place or reviewing their current policies.

PMI provides healthcare to individuals as an alternative to the National Health Service (NHS). Whilst simple in theory, PMI has a broad range of options and complexities, so it’s important Companies understand their options.

We have created this article to provide an impartial guide to all the key things you and your employees need to know about Group Private Medical Insurance. The article covers a broad range of subjects such as how the NHS was formed, how it provides the foundation of healthcare in the UK, how PMI interacts as an alternative to the NHS, and why PMI is such a valued employee benefit.

PMI is one of the most popular employee benefits available

In the UK all individuals are fortunate to have a National Health Service (NHS) which provides free healthcare to all. Private Medical Insurance is becoming increasingly sought after by employees. This is because there are significant waiting times for most treatments on the NHS. PMI provides individuals the opportunity to jump the queue and be treated quickly.

According to recent research conducted by business comparison experts Bionic, Group Private Medical Insurance is the number one Employee Benefit Insurance in the UK, so if you wish to be a leading company in your field, it’s almost becoming a ‘must offer’ Employee Benefit to provide.

A brief history of the National Health Service (NHS)

The NHS is rightly perceived as one of the UK’s greatest achievements. When Clement Atlee’s Labour won the General Election in 1945, it was acknowledged from a previous review, that many in the UK did not have access to Healthcare. Nye Bevan was made Minister for Health and resolutely took on the task of creating an NHS that was free of charge for all. Many opposed the proposals, including doctors and members of his own party, but Nye Bevan was a formidable negotiator and after a long period of solid debate in the House of Commons, he managed to put through his proposals.

In 1948, the NHS was founded and continues to be the largest single payer healthcare system in the world and is the world’s fifth largest employer. When the NHS was formed, no one could have foreseen the challenges it would encounter in years to come.

Challenges in the NHS

The NHS provides a fantastic service, but even before Covid, it was widely acknowledged that the system was breaking at the seams due to increased population, people living longer, and the cost of medication, specifically cancer drugs. The problem of the NHS has been further exasperated, due it being a political football for many years. Both major parties have opposing ideologies on how best to run the NHS.

The BBC recently covered 10 charts of why the NHS is in trouble:

- We spend more on the NHS than ever before

- A bigger proportion of public spending goes on health

- Key A&E targets are being missed

- The UK’s population is ageing

- Care for older people costs much more

- Increases in NHS spending have slowed

- The UK spends a lower proportion on health than other EU countries

- Demand for A&E is rising

- Fewer older people are getting help with social care

- Much more is spent on front-line healthcare than social care

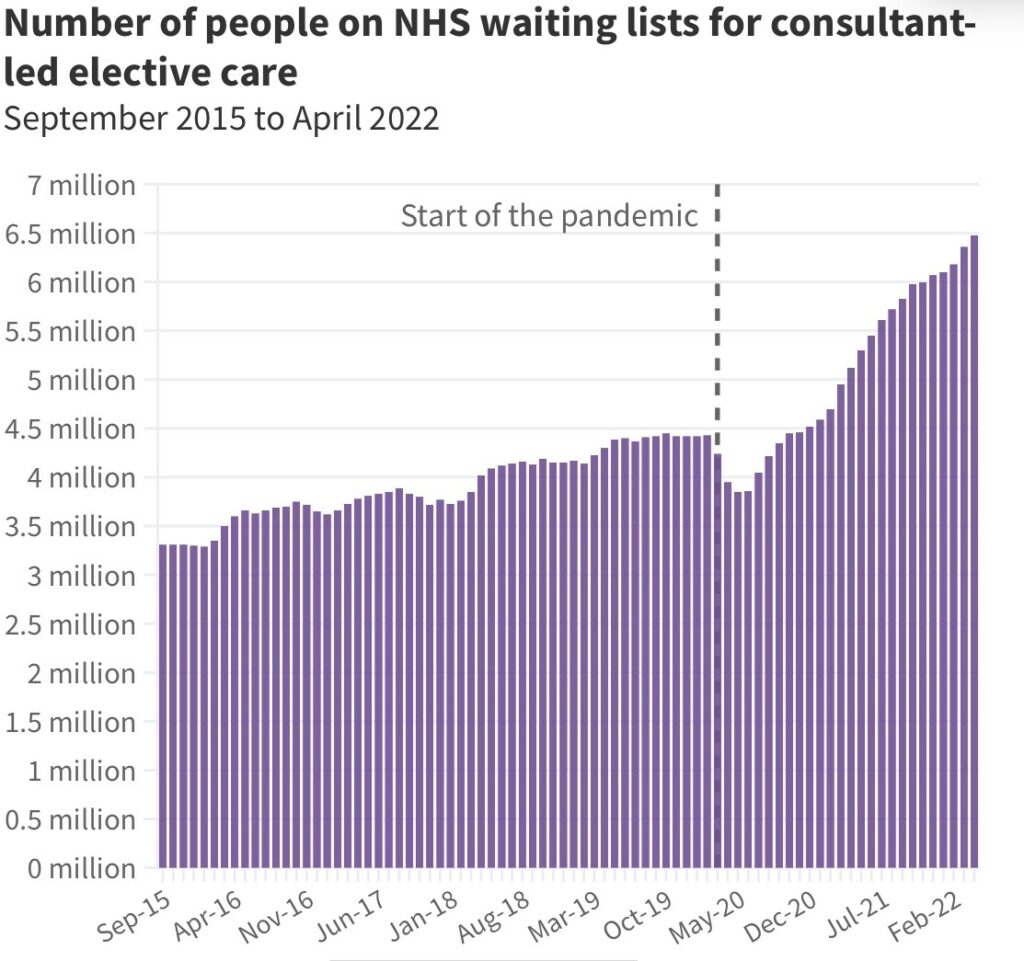

Since COVID, these challenges have been exacerbated further. The British Medical Association data shows the number of people on NHS waiting lists have over doubled since 2015 and have seen a 35% increase in waiting times since COVID-19.

From an Employee Benefits perspective, it would not be surprising to find in the future that Private Medical Insurance is not only desired by employees but is an expectation.

Future of Private Medical Insurance in the workforce

The number of individuals covered by Private Medical Insurance has steadily been increasing since 2008. The increase has largely stemmed from the length of time it often takes for treatment to become available on the NHS. The increase is not believed to be connected to the quality of treatment on the NHS, which broadly remains fantastic.

As with workplace pensions, it has been discussed that in the future, legislation will propose companies bear the burden of providing Healthcare for their employees. How this would look is hard to tell. Would it be based on size of Company, turnover, profit or just be a mandatory measure for all? There would also be significant obstruction with passing legislation like this. For now, a legislation like this appears to be many years away and may never happen, and this is just one proposed solution of many to the current NHS crisis.

One thing is for sure, because of the pressures on the NHS, Group Private Medical Insurance will not be going away, and its market share will most likely continue to grow as an alternative option for individuals to receive Healthcare in the UK.

As the market continues to grow, it’s likely that Companies will recognise employees’ expectations, and implement Group Healthcare to remain competitive in retaining and recruiting the best people.

What does Private Medical Insurance cover?

Private Medical Insurance in the UK is designed to cover the cost of treatment on ‘acute conditions.’ These are conditions that are deemed to be curable with treatment. Policies will typically cover:

- Cost of hospital admission

- Diagnostic tests such as MRI and CT scans

- Surgery

- Consultant fees

- Private hospital room and care

- Drugs that may not be available on the NHS

To varying levels, policies will also typically cover:

- Outpatient treatment

- Psychiatric care

- Complimentary medicines

- Physiotherapy

Examples of areas that may not be covered by Private Medical Insurance are:

- Chronic conditions – These are deemed to be conditions that require regular, ongoing maintenance. It is possible that these conditions may be diagnosed on the PMI, but ongoing treatment will typically be provided by the NHS.

- Emergencies are not covered as Private Medical Insurance in the UK typically works on a GP referral basis, however, aftercare from emergencies may be able to be covered privately.

Types of PMI Underwriting

There are broadly three main types of Private Medical Insurance underwriting:

- Fully Medical Underwritten (FMU) – Full disclosure of all medical history is required, and previous conditions may be excluded for further treatment.

- Moratorium (Mori) – Disclosure is not a requirement, however; cover excludes all pre-existing conditions from the last two to five years (depending on cover). It will exclude the conditions for a set period after (typically two years).

- Medical History Disregarded (MHD) – The highest level of cover available. Individuals are fully covered on the policy regardless of previous treatment on conditions.

What about Switch Terms? If you are changing employer where both your current and future employer provides PMI, there is the possibility of transferring to the new employer on something called ‘switch terms’ (also known as Continued Medical Exclusions). This ensures you can transfer to a new Company on like-for-like medical terms, meaning you will not be excluded from cover you’ve previously received whilst with your current employer. If you wish to do this, be aware of the following:

- You will need to provide your Medical certificate and must ensure there’s no break in cover. There is normally up to 14-30 days leeway with this but if you go over this timeline you may not be able to transfer on like-for-like terms. If in doubt, call both your current and future provider asap for guidance.

- Not all employers will provide this facility.

- Providers will review each case individually and may disallow cover on like-for-like terms.

- If an employee is moving to a Company with a Group PMI scheme providing Medical History Disregarded, switch terms are typically not required. This is because individuals are automatically covered regardless of their medical history.

How to make a claim

With Private Medical Insurance, one area where individuals can come unstuck (specifically foreign nationals, working in the UK) is when claiming.

In the UK it’s important to understand that the NHS underpins everything. A General Practitioner (i.e. Doctor) must assess you first, and once they’ve confirmed you need referring, you can proceed from there. If you do need to make a claim, you must follow the following process:

- Go to see your GP to be assessed

- Once referred call the Insurer for pre-authorisation

- Proceed with treatment

Whilst treatment with PMI can be very fast, one of the challenges may be getting a doctor’s appointment in a timely manner. When this is true, there is support available:

- Most medical providers will provide a GP helpline where employees can call to be assessed. These can be a great support, but for most providers are not comprehensive because they are provided by telephone. Therefore, further assessment may be required.

- Another solution is to see a private doctor. There will be a cost for this, but it is becoming more and more common for companies to provide this benefit through providers.

Types of excess

PMI is a P11d (taxable) benefit. This means the employee will be required to pay the tax on the premium the Company is paying for the employee to receive the benefit. Many schemes choose to have an excess in place to deter employees from making small claims. Many small claims can increase the overall premium for the group, and therefore have a negative impact on the taxable cost to the employee.

For most providers, an excess of anything from nil to £250 can be put in place. Typically, the higher the excess, the lower the premium rates. There are broadly two core ways the excess can be applied on a group scheme:

- Per person per policy year – This is where employees and their dependents will be required to pay the excess on the scheme for the first claim they make. If they make multiple claims within the year, they are only required to pay the excess once. However, if the claim carries over to the next policy year, the individual will be required to pay the excess again to continue the claim.

- Per claim – This is where the employee will be required to pay the excess per claim, per condition. If a claim on a condition carries over into a new policy year, a further excess will not be required.

Range of hospitals and consultants

When you have been referred by a GP, you will then have a range of hospitals or consultants to use, depending on your condition.

Medical providers will have their own product range which will offer different hospital lists per product. However broadly, their hospital lists will be similar and most offer a Core Hospital list and then an Extended Hospital list:

- Core Hospital List – Provides a range of hospitals and consultants around the UK where individuals can receive treatment. For most individuals this will be more than adequate regarding the choices available.

- Extended Hospital Lists – This will cover all the core range of hospitals available but may also cover some hospitals which are not on the list. Mostly, these are exclusively private hospitals and are largely concentrated around the London and Greater London area. It would be unusual for a Company to provide this facility to all employees because of the cost implications, but companies may provide this facility to senior staff.

Pros and cons of Private Medical Insurance

Having Private Medical Insurance is a valuable benefit, but as with most things in life, there are some Pros and Cons to be aware of. Whether Medical Insurance is purchased individually, or via a Company, one of the key evaluations must be a cost analysis, not just in implementing, but also sustainability. For a Company, this is difficult to assess because of the number of variables involved. For example, retention may not be directly impacted by a Company offering PMI, but it may play a part.

Here are some of the core Pros and Cons to be aware of:

Pros:

- Is deemed to be a valuable recruitment and retention tool (Company)

- Helps employees receive fast, effective treatment. Therefore, if they require treatment, they potentially have less time off work, and may not have to work with illness or injury for an extended period (employee and Company)

- Most PMI providers now provide additional health, and lifestyle benefits where employees have access to health and wellbeing support such as money off gym membership, and discounts with other retailers or services. This may help employees develop good health and lifestyle habits, which in turn can provide benefits to the Company such as a healthier, happier and more productive workforce. (employee and Company)

- Individuals can receive treatment in a hospital or consultant convenient to them (employee)

- Individuals may have access to drugs that are unavailable on the NHS (employee)

- Although the employee pays the tax on the premium, this is typically much less than paying for PMI individually (employee)

Cons:

What options are available with increasing Medical premiums?

- Events that may affect the premium can be unforeseen and unpredictable. If the scheme is not managed effectively, premiums can become unsustainable for a Company. (Company)

- PMI is a P11d benefit (taxable benefit). This means the employee pays the tax on the premium that the Company pays for the employee to receive the benefit. If premiums escalate, this can mean the taxable benefit to the employee becomes too expensive to afford. (employee)

- If premiums increase dramatically, the knock-on effect can mean employees leave the scheme. Proportionately, the scheme may become even more expensive because the risk is not spread to as many employees. Providers may review their premiums if a workforce increases or decreases 25% in a policy year. (employee and Company)

- If poorly administrated and communicated to employees, (either by the Company, the provider, or an intermediary) this can mean the scheme does not meet employee expectations. If an employee has received a poor experience on cover, their opinion can spread like wildfire. Therefore, good administration and communication is imperative. (employee and Company)

As you can see above, most of the potential ‘Cons’ of Group Private Medical Insurance are connected to cost. Whether a Company already provides PMI or is thinking of providing it, there is often a concern about how to control the premiums. Escalating premiums can be very damaging to companies so there are a range of options to mitigate the risks. However, as with all insurance, PMI premiums are based on risk, so many claims will affect future premiums, and this risk cannot be totally avoided.

The core way to affect premiums is connected to the level of cover in place (i.e. FMU, Mori or MHD). It is very difficult to reduce the level of cover, but not unusual for companies to begin a scheme on a lower cover level such as FMU and increase the cover overtime to either Mori or MHD.

Therefore, there are several other options to consider that can affect the premium:

- Review market costs annually – This is important and one that Companies and brokers often neglect.

- Excess – A scheme with a nil excess will have a higher premium than a scheme with an excess. Typically, the higher the excess the lower the premium rate. An excess will also deter employees making small claims.

- Age rated or unit rated – If you have a minimum number of employees, a unit rated scheme (where all employees have the same premium regardless of age) may be beneficial. It may reduce costs and will certainly be easier to administrate. It is far easier for P11D (taxable benefit) calculations.

- Part funded – You may wish to consider the option where employees bear part of the costs of PMI. However, be aware that some providers may not support this approach.

- Family – Should the Company allow employees to include their dependents and should the employee be required to pay for their own dependents, or will the company pay?

- 6-week option – Some providers provide a 6-week option. If the NHS is unable to provide treatment within 6 weeks, treatment can be provided privately.

- Length of service – Some Companies will provide employees access to the Private Medical Insurance scheme after a period of continued service. This can be anything from 3 months to two years.

- Outpatient limit – The outpatient limit can be adjusted to a range from a monetary amount to unlimited.

- Health and wellbeing – As an indirect preventative measure, Companies can implement robust Health and Wellbeing initiatives which promote healthy living. These can have a positive effect by increasing the health of employees. Statistically, healthy employees claim less than unhealthy employees.

Summary

Private Medical Insurance is a fantastic employee benefit and employers wishing to retain and recruit the best staff should consider implementing cover. However, because of potential escalating costs it is crucial employers receive the best advice. Receiving the support of an Independent Intermediary such as Bigmore Benefits will ensure the scheme is implemented or renewed in the best way.

If companies are considering implementing or renewing Group Private Medical Insurance, we provide consultation and fully review the market for costs to ensure the scheme is the most suitable. One of the most important features of our services is the added value we provide. We engage employees on behalf of our clients to clearly explain what medical insurance is, how it works, and how to get the most out of the scheme.

Article Written by: Dave Sykes