We've all been there.

You’re at a shop (it can be any shop) and your child see a shiny new toy, or favourite sweet treat, or a magazine about their favourite tv show and they beg and plead for you to buy it for them.

In your head you start to calculate all the other impulse indulgences you have given into in the last week and decide that this is the moment to put your foot down.

Nightmare.

There is crying, screaming, bargaining, promising. All of which was unavoidable.

But that’s the nature of children. And like it or not, it’s our role as parents to help them navigate their wants. To teach them the difference between wants and needs and, somewhere down the line, the role money plays in society.

There is no one way to teach your children about money. The value, the system, the mindset. What works for each child, each family, will differ. Though there is no fail-proof handbook on financial education for children, there are a set of concepts that we should endeavour to teach our children when it comes to finances. And we should start to teach them early.

This article will contain an outline of those concepts, and some examples of how our team uses pocket money and other techniques for the benefit of our children’s financial education.

Budget

Money management comes down to a budget. Quite simply, how to allocate the money you have in order to cover the ‘must dos’ and not overindulge in the ‘nice to haves.’ To begin to grasp this, children must first learn how much things cost and then see the connection to that cost and the money they have.

One way you can start to lay the groundwork is to give children pocket money. Providing children with pocket money gives them the ability to make decisions on how that money is spent. My 6-year-old is given £5 a week to spend as he sees fit. Some weeks it happens all at once down at the corner shop where he buys football cards and a sweet. Some weeks he spreads it out over the course of a few days. (Though it’s still usually spent on football cards and sweets).

Giving him a consistent sum of money every week means he is starting to notice how far that amount of money goes. He now knows that £5 is 5 packs of football cards or 3 packs of football cards, a kinder egg, and a lollipop. If he had different sums of money every week, I’m not sure he would be seeing the pattern form.

If giving pocket money isn’t for you, consider involving your kids in the household spending.

Grocery shopping is a good option, and you can do this whether you shop online or go to the store. Start by telling them how many days of groceries you are buying, how much money you have available to spend on those groceries and go through the process of making the list. To make it simpler, start with a day or a single meal. If you think they are ready, you can let them make all the decisions on what you eat and then they can craft the list within the budget you set.

Pointing out things such as sale items, price per weight, how prices varying by brand will also help them build skills around shopping smart. But remember to pace the lessons as too much information at once can be overwhelming.

Another option is to allow your child to plan an activity or a day of activities. For younger children pick a few things they can do, write down the price of each and let them organise the experience. Be sure to include things that don’t cost any money such as ‘trip to the playground’ and ‘family game night.’ This way they can see that there are options for fun that do not cost anything. I’ve done this with my sons on a £20 budget. They chose:

- Trip to the playground: Free

- Arcade: £10

- Trip to café for a pastry: £3.33 each to spend.

The process of planning the day was fun for them and it took the pressure off me to always be coming up with the ideas. Now I keep those pieces of papers to the side and pull them out whenever it’s their turn to plan a day. (Note: they always pick one free activity because they have already caught on to the fact that it makes the budget go further.)

If they are older, give them the budget and let them search online for things to do. One of our team has tried this and the activity was more than the budget, so their child offered to make up the difference so they could all go see a movie, with popcorn, together. The feedback was that the daughter was very happy and proud that she used her money on something the entire family would enjoy.

Savings

Teaching children to save is not easy. Especially in today’s world where there is so much emphasis on overindulgent consumerism. The habit of saving is not only about putting money away for the future, but also about detaching from the urge to spend everything you’ve got on things you don’t need. So how can we encourage our children to develop this skill?

Firstly, boundaries. The path of least resistance usually appears to be to cave in when kids want to buy something for £8 but only have £5. Anticipating the meltdown, the bargaining, the frustration when you tell them no can be enough for any parent to just make up the £3 difference. However, this does not support the aim of savings. I know it can seem overwhelming to manage the heightened emotion of demand, but after a few times of putting the boundary in place the arguing will begin to calm down.

Highlighting how they can reach the £8 total by saving their money rather than spending it now might not work immediately. But if it is something your child truly wants, it very well may. This can also help children begin to see that sometimes they want a thing just because they want things, and sometimes they want a thing because they want it. The most important part of this is that you hold the boundary. If you don’t reinforce the moments when saving money is necessary, the habit will take longer and be more difficult to develop.

It also helps to show them the numbers.

If your child wants an item that costs £50 and they only have £20, write down how long it will take them to save up for it based on their pocket money and/or chore money. If your child likes visual charts, use one. (Here is a link to download our simple template for printing.) By laying it out with real figures and a clear timeline, saving becomes less of a nebulous concept.

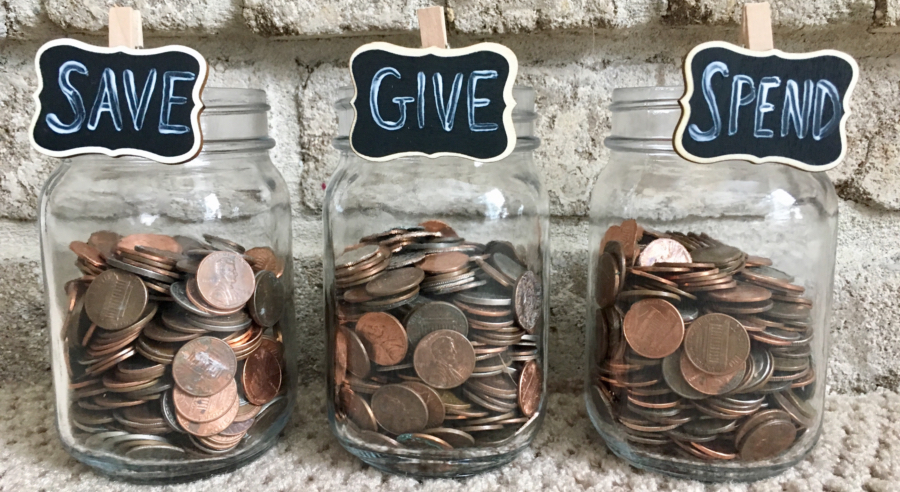

It’s also a good idea to have a place for them to keep the money. Whether it’s a wallet, piggy bank, bank account or one of the many kids debit cards that are on the market. Some kids might prefer to see and hold the cash. Others might be more inclined towards the card system. If your child has a preference, do what you can to be supportive of that. If you find they are engaging with learning these concepts better with coins and notes, do what you can to have physical money around. My 6-year-old is much more engaged with physical money, which is a bit annoying. But I take out some cash every so often, ask the shop round the corner for a variety of change when I buy something and keep it high up in a cupboard. I tried to force him to use a card system, but his engagement disappeared. So here we are with cash money again!

And if you have a savings account for your child, whether it be a standard bank savings account, Junior ISA, etc, show them how it is growing over time. Regularly update them on how the account is doing, how much has been put into it, how much interest it has gained and possibly the projected growth of the account. This can also help start to teach them about the concept of interest.

Interest

Interest is the amount of money your money makes or costs. There is both good and bad interest. The good kind being what you earn on money you are saving, the bad kind being what you are paying for buying on credit.

When it comes to good interest, you can make an agreement on a higher ticket item that if your child saves X towards it, you will contribute Y. Though it might not be easy to explain that this can be considered a type of “interest,” introducing the concept of how saving money has the potential to earn you money will help with mindset.

You can also simply offer them interest on the money they have saved over a period of time, say every month. At the end of the month look at what they’ve managed to not spend and offer them a percentage. Perhaps keep the percentage consistent so that they can anticipate what the top up will be each month. Or vary it based on the Bank of England base rate. Up to you.

Now reverse the process to teach about bad interest.

Child wants a pricy item? Lay out the money for them but have them pay back more than you’ve loaned. For example:

Child wants a £20 item. They only have £15.

They don’t want to wait a week for their next pocket money or do chores to make up the difference.

If you offer up the £5 have them repay £7.

You can then either not give them pocket money or chore money they earn until the £7 is repaid, or give them less pocket and chore money until they’ve paid it back. This might be a tough one for little kids, or children who aren’t inclined to do chores unless there is something they want to buy, but at some stage a technique like this will make an impact.

And as with savings, write it all down. Show them the amount they have borrowed, what they must pay back and how long it will take them to do it. (Click here to download our simple chart for repaying borrowed money.) The other benefit of having your child pay interest is that it helps introduce the concept of deferred gratification.

Deferred Gratification

When you defer gratification you do not indulge your immediate urge. Why is this relevant to finances? We live in a world the encourages immediate gratification. Not only encourages but also enables. It is remarkably easy to get credit. To buy now and pay later. But choosing this option will have you paying more for an item than its advertised price.

This might be a lesson where you need a real-life example to hammer it home. But if you’ve been teaching about interest with the repayment method, you will have laid the groundwork for the concept.

In a previous article, one of our advisors discussed the importance of teaching deferred gratification to children. I will reuse his example here.

His son wanted to buy a new game console but did not have the money to pay for it upfront.

A popular high street retailer was offering the item for sale with an option to pay in monthly instalments. The advisor sat down with his son and showed him how much more he’d be paying for the item due to interest if he opted to make the purchase this way.

*These numbers are approximate amounts.

The retail price for the item was £450*.

The instalment payments were £15.50* over a 36-month period.

He would be paying £558* on an item listed for £450*.

Thus, paying £108* more than the sticker price.

Yes, he would have the console today, but he would be paying for it for the next 3 years. And be paying an extra £108* for the privilege. The solution they came up with was to crunch more numbers.

How much did he have now to put towards it, and how much did he realistically think he could save per month to buy the item outright? Though this decision would mean he would have to wait 6 – 8 months for the console, he not only learnt the financial value of deferring gratification but also utilised his skills of savings. Not to mention the additional benefit of seeing how to work out the true cost of an item when you calculate for interest.

This is arguably one of the most important lessons we can learn before adulthood. There will be plenty of big-ticket items you might want to buy when you get older. A car, a holiday, a property, an expensive item of clothing. If you help your child understand the benefit of tempering that want/need with planning and saving and then begin to help them practice it, you will be setting them up for success in the future.

Money Must Be Earned

There is a bit of a divide in our office over whether pocket money should just be given, or whether it should always be earned. To be clear, there is no right answer. There is only the answer that works for you. Personally, I use a combination of consistent pocket money and top up money available through chores.

For me, giving a consistent sum of pocket money means my kids have autonomy over how they spend their money. It limits the meltdowns and negotiations about what they may be allowed to purchase from a shop and is showing them how far a specific sum of money can go. The benefit of adding in chores is that they are also learning that money is earned.

Granted that doesn’t mean they always do the chores.

We get tons of push back over the fact that the chores don’t earn them enough money or there is nothing they want to buy right now so they have no need for money. This is when it can be helpful for there to be something a bit pricier that they want. We had success with this when my son wanted an Echo Dot for his bedroom. We employed the technique of you save X we will contribute Y, which had him eagerly doing any chore we could come up with. He felt very proud of himself for earning his Dot. And he appreciates it more than most of the things we’ve bought him. The sense of accomplishment is not lost on him, and there have been times when I’ve used this purchase to remind him of:

1) he has the ability to save his money

2) if he puts the effort in, he can reach his goal

3) how proud he was of himself when he did it

There have also been times when we’ve openly discussed why a person needs to work. Usually when he’s complaining about needing to go to school. He needs to go to school, his parents need to go to work. He goes to school to learn. We go to work to earn. Inevitably he asks why. So, we explain in a way that we think he can understand. Sometimes he says he does, sometimes he says he doesn’t, sometimes he just starts talking about something else. Whatever the result of the conversation, he has been introduced to the concept of how and why money is earned. It’s a start and that’s what I’m aiming for at this age.

Final Pieces of Advice from the Team

Keep things age appropriate

You will have a better idea of what concepts your child will be able to grasp than anyone else. Take it at the pace that works for them and for you. Use language and examples they can understand and connect with. And know that repetition is key.

Start Early

The sooner you introduce these ideas, the more time your child will have to develop and build on them. This doesn’t mean they are guaranteed to be brilliant with money in their adult life. Some things are down to nature. But it will hopefully mean that they have awareness of the consequences (both good and bad) that come with their decisions.

Keep Going

When starting off it can seem like you are getting nowhere. It can be stressful and frustrating, and you might want to just roll back on the systems and rules you’ve laid out. Don’t. You must keep going. Tough as it might be, keep thinking about the long-term benefits and hold these boundaries.

Have Conversations

Don’t shy away from talking to your kids about money. Clue them in to how you navigate spending and saving. If you have debt from choices you made in the past, and they are old enough to understand, explain to them how you’re managing it. Be honest if it’s something you wish you hadn’t done. If it’s something you wish you had been educated about.

Reflect on Your Own Relationship with Money

How money was spoken about and managed when you were growing up will have a direct impact on how you navigate it now. Thus, how your children are spoken to and clued in about how money is managed will impact them in the future. The more you understand your own views and experiences, the better you can guide them towards a healthy relationship with money. If you’d like to learn about more about this, read our article The Psychology of Money.

There is no one way to provide a financial education for children.

No matter what techniques you use or how long it takes to establish these ideas, just know that the effort you are putting into your child’s financial education now will have a profound impact on their future. Whether you were taught about money or not as a child, there is no doubt that you understand the importance of having that education. It’s why you’ve taken the time to read this article.

So, if you’ve found tips you think you can use, give them a try. Any amount of education is better than no education. And when it comes to such an important element of life, the worst thing you can do is nothing.

Article by: Jill Rensing

and the Bigmore Associates Financial Planning Team

Difficult Conversations with Ageing Relatives

Previous post

Difficult Conversations with Ageing Relatives

Previous post