Overpaying on Your Mortgage

If you’re a homeowner, you may have heard that overpaying on your mortgage can be a smart financial move. But how does it work and what are the benefits?

When you overpay on your mortgage you pay more than what your monthly repayment is. This often works in two ways; overpaying a smaller amount each month or paying off a larger lump sum. Whichever way you make these overpayments the main goal is to pay off your mortgage sooner, therefore saving money in the long run.

There are over 1.6 million fixed rates ending in 2024. A majority of these mortgages will be subject to a massive increase in interest rates which could see monthly payment amounts more than double. Therefore, if you have the funds available, you might want to consider making a lump sum payment towards your mortgage.

Lump Sum Payment – The Financial Figures

By making a lump sum payment before switching from a low rate to a high rate, you can save money on interest over the long term. Here is an example:

A mortgage balance of £100,000 with 20 years remaining.

Coming to the end of a fixed rate of 1.50% and moving to a rate of 4.50%.

- £100,000 mortgage over 20 years at 4.50% = £51,787 total interest paid.

- £90,000 mortgage over 20 years at 4.50% = £46,608 total interest paid.

By making a £10,000 lump sum overpayment prior to the new mortgage starting at 4.50%, this will save a total of £5,179 in interest over the 20-year mortgage term.

With a reduced mortgage balance moving forwards, this will in turn decrease the property’s loan-to-value (LTV), resulting in better rates being made available, as the more equity there is in the property, the better the interest rate you qualify for.

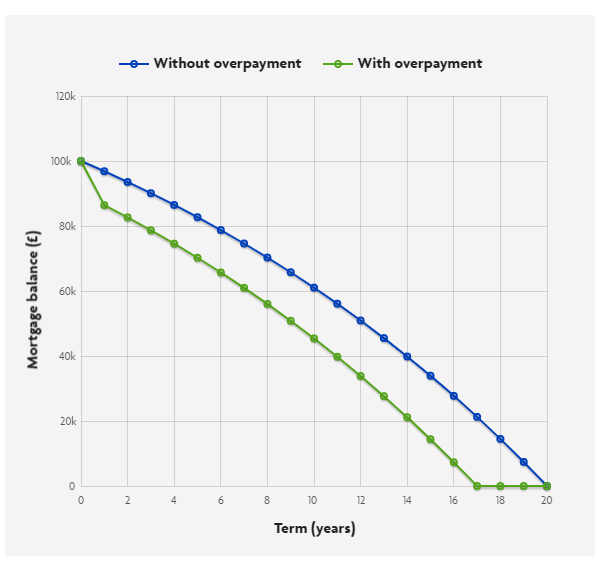

Monthly Overpayments – The Financial Figures

If you do not have the funds available to make a lump sum payment, overpaying each month can still reduce the overall interest you will pay. Let’s look at the same example from above.

A mortgage balance of £100,000 with 20 years remaining.

Coming to the end of a fixed rate of 1.50% and moving to a rate of 4.50%:

- With an interest rate of 4.5% over 20 years, overpaying an extra £100pm reduces the term to 16 years and saves £11,467 in interest over this time.

Though it might seem at the time that an extra £100 a month won’t make a dent in a £100,000 mortgage, the additional payment adds up over time. Even if £100 a month every month is not possible, any amount at any point will make a difference to the interest paid over the lifetime of your mortgage.

Things to Consider

Whether with a lump sum or monthly payments, there are a few things to consider before choosing to overpay on your mortgage:

Is this affordable to you?

Once an overpayment has been made towards the mortgage, it is not possible to access these funds again. Will this overpayment take away from your emergency fund to pay an unexpected bill for example?

Can the funds be used to reduce any unsecured debt balances e.g. credit card, loans etc.?

Before allocating extra money towards the mortgage, it is worth reviewing any unsecured debts in place, and if these can be repaid sooner. These types of debts tend to have a higher interest rate compared to a mortgage. You must consider if your funds be better used to clear these balances. This could potentially free up income that could be utilised to make regular overpayments towards the mortgage.

Will a penalty charge be incurred?

Generally, most lenders allow overpayments of up to 10%, with a handful of lenders allowing up to 20%, of the mortgage balance to be paid without incurring a penalty during each year of the tie in period. Any payment over this allowance will incur an early repayment charge, set by each lender.

In some circumstances, it could be worth incurring a penalty to reduce the mortgage balance whilst you are on a low interest rate before the low deal ends and the new mortgage takes over on a higher interest rate. Always speak with a mortgage professional before going down this route, to ensure you are taking the best overall financial decision.

Other Interest Saving Options

If making overpaying on your mortgage is not a viable option to you, there are other means available to limit the interest incurred over the lifetime of the mortgage:

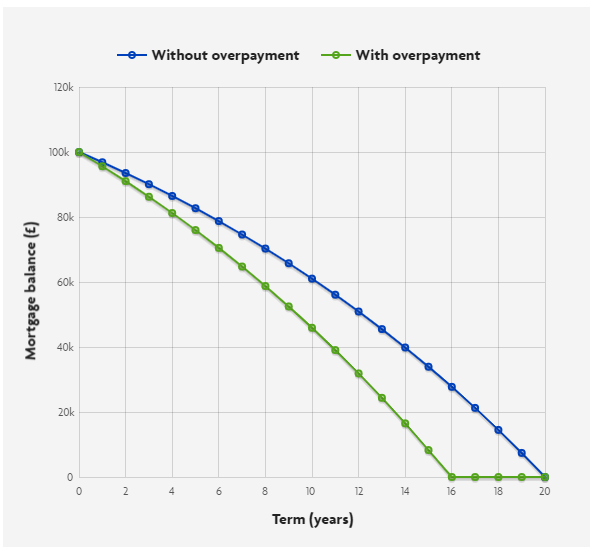

Shortened Mortgage Term

If your goal is to repay the mortgage as soon as possible reducing the mortgage term can limit the amount of interest incurred over the mortgage term. This will increase the monthly repayments, so you must ensure you have the income to support increased payments. We will use the same example from above.

With a £100,000 mortgage at an interest rate of 4.50% and 20 year term, total interest of £51,787 will be incurred, at monthly payments of £632.

However, by reducing the term to 16 years this would incur total interest of £40,425, at monthly payments of £731. An increase of just £100pm reduces the overall interest incurred by £11,362 and ensures the mortgage is repaid 4 years sooner.

The financial figures of a shortened mortgage term are like that of making monthly overpayments. The main difference is that if you do shorten the term you are contracted to make those higher payments. When choosing to overpay you can decide how often you make an extra payment and what amount it is.

Shortening the mortgage term is typically done when your current fixed rate is up as it is a new contractual agreement. Making a discretionary monthly overpayment can be done immediately.

Offset Mortgage

As an alternative option to making an overpayment, taking out an offset mortgage can be a great solution to reducing the amount of mortgage interest incurred, whilst also retaining access to the funds if needed.

An offset mortgage functions similarly to other mortgages in most regards:

- It is a secured loan enabling you to buy a property or remortgage a property.

- It can have a term of up to 35-40 years, it can be capital and interest or interest only.

- It can have a fixed-interest rate, or something else.

Where an offset mortgage is unique is with the addition of a linked savings account.

When the new mortgage starts, the borrower will designate a savings account (usually a new savings account with the same lender offering the mortgage) which will be linked to your mortgage. Any funds deposited in the linked savings account will be, as the name suggests, offset against your mortgage balance, meaning you only pay interest on the difference between the two balances.

Once funds have been deposited in the offset saver account, they are effectively regarded as having reduced the balance of the mortgage by the total amount in the account, so long as the money remains in said account.

To learn more about what an offset mortgage is, please download our Guide to Offset Mortgages.

Get Personalised Advice

Ultimately making an overpayment towards the mortgage can be worth it, providing you have the spare funds to do so. This will reduce the mortgage balance, allowing the mortgage to qualify for a better interest rate moving forwards, limit the monthly repayments and importantly restrict the level of interest incurred over the mortgage term

As with any big decision, it is advisable to speak with a professional who can guide you through the various options available and illustrate the implications of reducing the mortgage balance. Though this article has given you an overview of the possibilities, it is important that you personal circumstances are considered thoroughly.

Should you be interested in further, bespoke advice our mortgage advisors are on hand to carry out a full review with the aim of putting you in the best financial position with your mortgage. Please fill out the contact form below if you would like one of our advisors to contact you.

Article by Chris Layzell

Head of Mortgages & Protections

Financial Shame

Previous post

Financial Shame

Previous post