The New Year is upon us and a dawn of expectation is in the air. For many, the period provides a rare opportunity for genuine reflection. A time to take stock for the coming year, and this is the ideal time to get on the train to Financial Wellness.

If you’re the type of person that likes making New Years Resolutions, you’ll no doubt be making a list of goals which will be centred in some small way around Health, Wealth, and Happiness and inevitably, your resolutions will be either directly or indirectly attached to money.

Very few goals in life are solely financial goals. For example, making an arbitrary goal of earning ‘xyz’ would mean nothing without a reason behind it. In reality, most goals stem from a desire to achieve or attain something. Money is merely used as a tool to help you achieve those goals.

Many of us fail to meet our wider goals because of our relationship with money. We often do not feel comfortable talking or thinking about our financial situation, but as Zig Ziglar says “Money is not the most important thing in life, but it’s pretty close to oxygen on the gotta have it stakes.”

So to guarantee success in 2019, here are some great tips to help you manage your finances more effectively:

1

To get started, block out a day of your time

How serious are you in achieving your goals? Many of us fail before we’ve even begun. Blocking out a day of your time without any distractions, will help you to plan and implement some of the following suggestions:

2

Create a budget plan

Every individual knows that they should have a detailed budget plan. i.e. How much do you earn and how much do you spend. However, a whopping 70% of the UK don’t have a detailed budget plan, so creating a budget plan must be your absolute priority. Get the basics down first, and then make sure you take account of the big one offs. One of the biggest mistakes people make is not taking account of the big one offs such as car tax, Christmas, birthday’s etc. Get in the habit of putting monthly amounts away for these events. Once you’ve completed your budget plan, you can then go through all your items in more detail and establish the areas you can maybe make some savings.

3

Financial Management

Once you’ve completed your Budget Plan, your finances will broadly fall into two camps. Allocated, and Remaining. The allocated parts signify your regular liabilities and savings, and the remaining signify the areas you have available as spending:

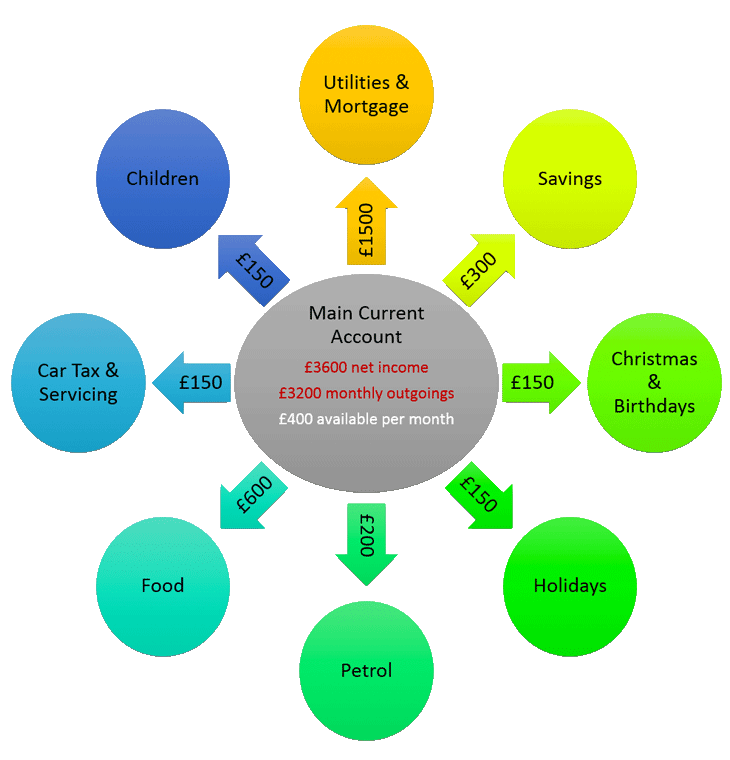

- Allocated – A good idea for your liabilities and savings is to ensure they are farmed out of your main account the day after you get paid. The benefit of this system is once the liabilities and savings are farmed out, you have protected yourself from accidentally spending money that should have been allocated. You can have as many accounts as you like and you may choose to have a different account for most categories. There are also banks such as Starling Bank https://www.starlingbank.com/ which will allow you to create your pots very simply internally from the same current account. The below diagram is a good example of this concept in practise. The amount remaining in your main current account is categorised as spending for the month.

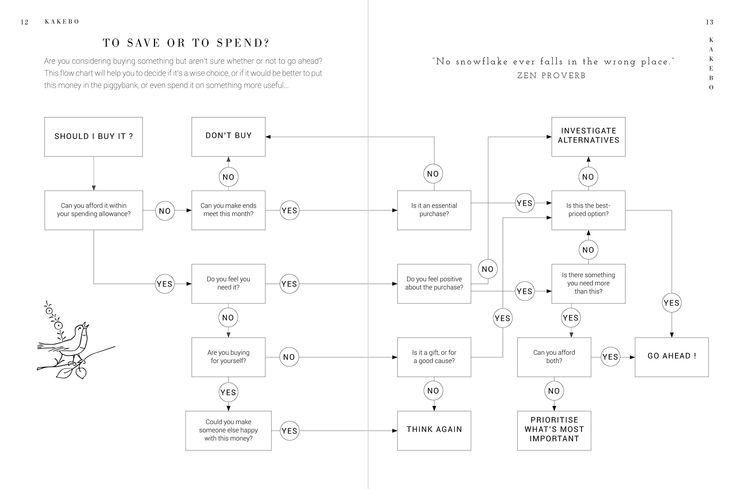

- Remaining – For your remaining fund there are not really any specific rules other than making sure you don’t spend more than your remaining allocation. However, there are some very good behaviours that you can form and one of the most effective structures is the Kakebo. This is a Japanese method of spending and saving:

4

Spend less than you earn, and invest the difference

When you create your budget plan, saving should be a mainstay of your plan. Regardless of the amount you’re able to put aside, getting into the habit of saving is the key to ensuring you will have enough money for future provisions. Two keys tips to this part are:

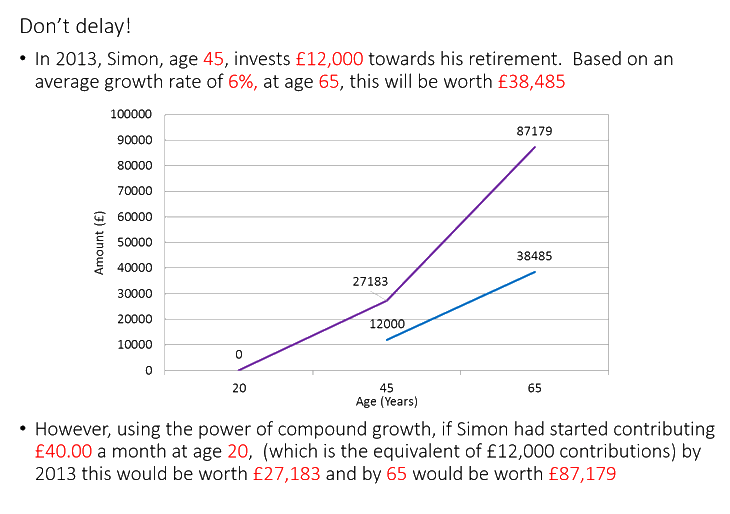

- One – the earlier you start the better because you’ll be taking advantage of the power of compound interest. Below is an example of the power of compound growth:

- Two – Don’t push yourself to hard. When you push yourself too hard this is when you may be likely to hit a wall and stop saving. Then you may forget to restart. It’s much better to make sure you can remain consistent over a long period of time.

5

Don’t make goals, make lifestyle changes

The trouble with New Years Resolutions or goals is that they are often temporary. For example, you may have made a New Year Resolution to lose weight. The trouble with this is twofold:

One – Many people give up before they reach their goal because they haven’t made the relevant provisions to succeed, and;

Two – Even for those who reach their goal, what then? Invariably the individual puts the weight back on.

If you really want to make lasting change, make it a lifestyle change. From a financial management point of view, this is why the Kakebo method can be very effective, because it brings your spending habits into your lifestyle, and ensures you are reviewing your spending habits on a daily basis.

6

Invest in yourself

As a financial advisor, I’m regularly asked; what is the best investment? Of course, in the financial world there is no correct answer as it depends on a number of areas. The best answer however, is to invest in yourself. Read books, allocate time to study, eat well, exercise, watch documentaries, practise your profession. By doing this, you’ll be creating numerous areas where you can provide value.

7

Find ways to add value

When you go through your budget plan, you may or may not be pleasantly surprised. Typically, the norm is that most of us want to earn more money. If you invest in yourself, higher earnings will inevitably be the result from the additional knowledge and skills you develop. In addition to this, look in detail at your current role at work, and consider the areas that you can provide additional value to the company. Go above and beyond to start adding value, and invariably, if you’re adding enough genuine value, you’ll achieve that sought after pay rise, often without asking.

8

Use technology… But not too much

Technology has the ability to make life easier, but it also has the ability to make life more complex. Many of us are suffering from technology overload and digital distraction which is actually making us less productive. So the trick is to find apps and technology that serve you. Life Hacker website provide some great suggestions on apps that may be able to support you with your Financial goals. http://www.lifehacker.co.uk/2016/01/28/the-11-best-money-management-budgeting-and-personal-finance-apps-for-android-and-ios

9

Review and Perfect

Once everything is up and running, the important thing is to review your finances regularly. The Kakebo format will be able to help you achieve this on a habitual basis, but additionally, it’s important to have wider reviews on a monthly basis to ensure you’re staying on track. If something isn’t working, adjust your strategy.

Inspiring Change

One of the things we love to do at CB Benefits is inspire and educate. If you want to find out more about the Financial Wellness services we provide, please visit the Financial Wellness section on our website, or contact us on 01483 881111.