Money Mindset

Hi, my name’s Pinky and I have a problem: money. I think money problems are relative. Someone might look at my situation and agree it’s not great. Another might think I’m doing fine and even wish to be in my position. What’s important isn’t anyone else, but how my situation affects me. Do I have financial wellbeing? Am I happy with my money mindset? My answer to both those questions, is no.

I’ve ignored all of this until now.

I’ve long had challenges in this area, but I never looked at it or tried to change it because I was somehow ‘always OK in the end’. I was never destitute, so I carried on as I was. I made myself feel better by comparing myself to those worse off than me. But the real crux of my avoidance was this: it was all too painful and scary. I didn’t dare look at it.

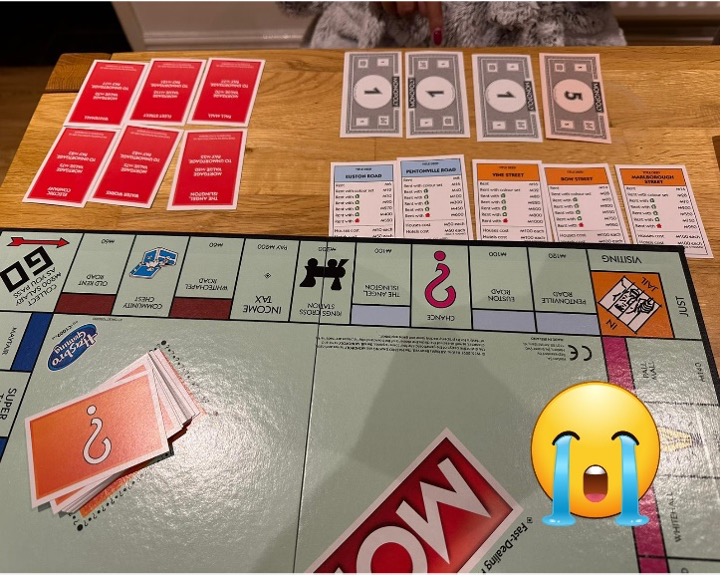

Until recently that is, when a game of Monopoly laid it bare, right in front of my face!

I didn’t plan to expose my money mindset over this game, I was playing for fun not for life lessons. But quickly, this game that I hadn’t played in about 25 years turned from fun and frolics to an emotional rollercoaster, with painful realisations and a wild display of my dysfunctional money mindset.

As soon as the game began, I found myself winging it and having no long term plan. My only strategy during the game was to hoard my cash because having no money terrified me. I was also scared of spending big, so I only bought cheaper/ mid-range properties.

When I had to pay rent to my opponent (and lots of it), I was angry and resentful. And every time I came upon the ‘Super Tax’ and ‘Community Chest’ demanding more of my money, I got angrier and more anxious. It felt so unfair.

I started to notice my cheap property investments were bringing very little income – what a waste of money they were – and as my cash started running low, I panicked. As I neared my demise, I made jokey jabs at my opponent being ‘the greedy rich folk taking all my money even though I had none’.

Throughout the game, I kicked myself for my poor decisions and failures. I felt shame and anger. I entered a downward spiral of hopelessness. I gave up and I lost.

And that, folks, is when I realised that monopoly mimics life. These are all things that I think, feel and do with real money, in the real world:

- Whilst I have a few investments, I do little long-term planning. At age 40 I think I should have done more in this area.

- Hoarding cash and fear of running out is so common for me. I experience gut wrenching, heart stopping, paralysing fear when cash runs low, or a big bill comes in.

- I always feel unworthy of success and struggle to increase my income. My overall wealth fluctuates like a yoyo and I waste money on ‘cheaper options’ and impulse purchases.

- I sometimes resent the ultra-rich – why do 1% have 50% of the wealth? Why is insider trading not stopped? Why aren’t we taught this stuff at school? So many questions.

- One that didn’t show on the monopoly board is that I’m also afraid to talk about my money, even with my fiancé.

- And the self-criticism, emotionality and hopelessness about it all? That’s my daily playbook.

How I yearn for greater financial wellbeing. I really do. Inside me and outside of me.

Well, the only way out, is in.

After nearly 20 years in the self-development industry, I know that if we want to change ourselves and our lives, we must start by looking inside and asking: Why am I the way I am?

This isn’t so we can chastise ourselves further for all our financial foibles, but because self-awareness is the foundation of all personal change.

So…

Why do I struggle with money?

As I looked across the Monopoly board at my fiancé who had won that game, comfortably, I reflected on how he never gets so stressed and upset about bills. He doesn’t lose his cool, make silly, reactive decisions or take jabs at ‘the elite’. I know he has his own money mindset niggles (we all do), but he doesn’t suffer like me. So, why me? Why do I have such a poor money mindset?

The answer lies in our childhood.

Most of our experiences as adults in all areas of life, not just money (relationships, health, work etc.) are dictated by our childhood. We formulate our beliefs in those early years based on what we experienced, and those beliefs become unconscious. They then drive the way we think, feel, act and the results we get, for the rest of our days. As Carl Jung said:

“Until you make the unconscious conscious, it will direct your life and you will call it fate”.

So, Iet’s make my unconscious, conscious. Let’s explore my childhood experiences with money and see how they’ve shaped my mindset:

Money was the most important thing.

At home, money was more important than health, happiness, relationships, everything. And I mean, everything. Whether you had £10 or £10,000, money would always come first. Money was more important than me – and boy did I resent that.

Money was a predominant source of arguments – especially spending or ‘wasting it.’

Money was linked to anger, rage, shame, punishment, control and criticism. I have umpteen stories from being scolded and punished for spending as little as £3 (and we could afford it), to witnessing family arguments about money for years on end. This gave me a severe distaste for anything to do with money because it was the source of such pain and suffering.

Women were seen as incapable with money.

Women could earn money but we weren’t trusted with managing it or spending it – that was for the man of the house. A learned helplessness ensued that meant some women didn’t even try to have more responsibility, they just gave in. And gave up.

Money was the measuring stick for worthiness and success.

You could have achieved lots and been the most amazing person, but all that really mattered was your bank balance. Like all these themes, this one lives on – just 12 months ago my dad demanded of me: “how much do you have in your bank account?” and even though I didn’t reply, he continued: “you’ve achieved nothing.”.

Based on the above, it’s no wonder that money leaves such an icky taste in my mouth. My whole experience is marred by shame, anger and self-criticism. It’s loaded with fear, anxiety, avoidance and incapability. Although I was never desperate for food, shelter and basic resources as a child, from a mindset perspective, I was in poverty.

The past is over – a new money mindset begins now.

It would be easy to blame and resent my past for my troubled money mindset. There are many reasons for my experiences – my parents are Indian immigrants who came from poverty, they came to the UK with nothing and even though they built wealth, their mindset of scarcity, poverty and fear lived on. And I adopted it. There are cultural reasons, gender biases, time differences, generational beliefs, toxic behaviours and family traumas that all contributed to my experiences. It’s good to know this, but here’s the bottom line: the past is over.

If I want a new money mindset, I must choose to start over and realise that right here, right now, is a fresh, blank canvas. I am no longer that child. I am a sovereign adult and I can create a new money mindset that doesn’t carry the limitations of the past and instead, carries the possibilities of the future.

Writing my new money story.

Here’s an exercise I like to do to shift my money mindset, let go of the past and write my own, new story based on truth, love and wisdom:

- I imagine I’m floating high up into the sky above my current situation/ challenge.

- I visualise myself dropping all thoughts and feelings down below, releasing those stories of incapability and unworthiness and those feelings of fear and resentment.

- I imagine being free and spacious, like a newborn baby here for the first time, with no past, no baggage and no beliefs.

- From this higher vantage point, I ask myself: what is true about this situation? What can I now see? I let my mind reveal it to me.

The answers I get can be enlightening, inspiring, relieving and more. They can be insightful and practical. Here are some examples:

1. Not everyone wants to shame or punish me about money.

Most money conversations in my familial home were full of shame and fear, which is why I avoid talking about my money now, even with my fiancé. It triggers me big time.

But from this higher vantage point, it’s so obvious that my fiancé isn’t going to shame or punish me. He’s helpful, kind, patient, loving and wants the best for me and us. We’re on the same side. I’m in a safe space now as an independent adult, with a supporter not a shamer by my side.

And thus, we can talk about money in our home, we can work together on it. And that’s what we’re doing. It’s not easy, I do sometimes act out my childhood wounds, but we understand this because we spoke about them. This boosts both our financial wellbeing and our relationship.

2. Money is inherently neutral; it is not good or bad.

Looking at my past, I realised that I actually hate money! It’s caused me such suffering that I am hostile towards it and full of bitterness.

As I rise above this, I see money circulating across the globe and realise that it’s inherently neutral. People can use it in adverse ways, they can argue, shun, shame and control over money. But that has nothing to do with the money itself. That’s to do with the people. Money is not bad, it just is. There’s no reason to hate it, in fact, I could even like or love it!

3. My worth is in who I am, not in my bank account.

When I rose above this belief about my worthiness being linked to my money, I gained a wiser view about me and my life.

It became glaringly obvious that people who value me don’t even know what’s in my bank account. They value who I am as a person and many other things about me, but not my money. The only person measuring me on money, is me (because I learned to, as a child). And I can choose to stop. What a relief!

4. I'm not incapable of managing money. I just haven't learned it yet.

As well as growing up believing that women were incapable with money, no one taught us about taxes, investments, interest, banking, loans, wills, inheritance, mortgages, pensions and more. Yet these are critical to our wellbeing in the modern world.

When I see this bigger picture, I realise that “I’m not capable” doesn’t hold any water. How can I expect myself to be capable in something I was never taught and haven’t done? I’m not incapable, I just need information, education and practise. And that is available to me, right now.

Change is a journey of baby steps

For me, this mindset shifting journey is like peeling an onion. I can only see the layer in front of me – that is, the thing that’s hurting me most and perhaps quite literally like an onion, making me cry. So, I take that and work on it: I rise above it, receive higher insights, I choose them daily and act on them where required.

It can take a couple of weeks to shift a single issue, or sometimes the flash of enlightenment is immediate and irreversible. I may see physical results (which can take longer) but I definitely see emotional results as my anxiety, fear and distress disappears.

Then, the next onion layer is revealed. The next trigger, the next challenge, the next limiting belief. I take that and repeat the process. This stepped approach makes it all more manageable, less overwhelming and gives time for my new money mindset to settle in.

As I do this work, I remember that my money won’t change unless I do. Did you know most people who win the lottery lose it all again? It’s because they didn’t shift their mindset. I’m choosing the journey of deep mindset work with patience and grace, for sustainable results.

Watch this space as I’ll be reporting my progress in a few months. I’ll share what worked and what didn’t, any new tools, learnings, and experiences. Or, if nothing changed, I’ll be totally open about that too! Wish me luck and I’ll see you then.

“All wealth is created with the human mind.”

Paul McKenna, ‘I Can Make You Rich’

Article written by Pinky Jangra

Pinky is a resilience and wellbeing trainer and speaker with nearly 20 years of experience in human development. She has trained with some of the world’s top specialists in this field and was recently featured on BBC Asian Network Radio and UK Health Radio sharing her expertise.

Pinky has a great passion for empowering staff in improving their health, wellbeing, performance and fulfilment, both inside and outside the workplace. She also understands the challenges of the modern workplace, having spent over 10 years working in professional services and high-pressure management consulting roles. Her talks and trainings are impactful, practical and relatable. They have been enjoyed by thousands of people in a variety of roles and industries, including the NHS, insurance, banking, central government, law firms, charities, management consultancy, universities and more.

You can learn more about Pinky, connect with her and enquire about her services on her website: www.pinkyjangra.com and LinkedIn: https://www.linkedin.com/in/pinkyjangra/

What are Employee Benefits?

Previous post

What are Employee Benefits?

Previous post